One of the primary objectives, and likewise challenges, of brands in the digital space, is making sure you can be found. This is important not only from an organic search perspective but a paid ad perspective as well. Today’s brands work tirelessly to find the right mix of media to ensure they are in the right spot at the right time for their consumers.

If your financial institution has recently gone through or is considering going through, any one of the following, being found through digital branding is critical. For instance, if your bank or credit union has: rebranded, renamed, merged/acquired, opened a new location, expanded your charter or footprint, or is looking at aggressive growth goals – this article is for you.

Much like how radio and billboards can be great tools for generating brand awareness in the wake of a rebrand or expansion, digital branding is also a great tool to tell your story to the market. Here are the top five things you should do to digitally brand better.

FOCUS

- Optimize, optimize, optimize. Even if your brand, name or footprint has not changed, optimizing your website and the mobile app should be a continuous journey. For instance:

- Submit and update the sitemap of your website with Google Search Console. This will allow Google to match searches with pages on your site easier.

- Label all of your product and service pages with structured data. This is definitely a step you will want your web development team to take with you, but it helps search engines find relevant data easier.

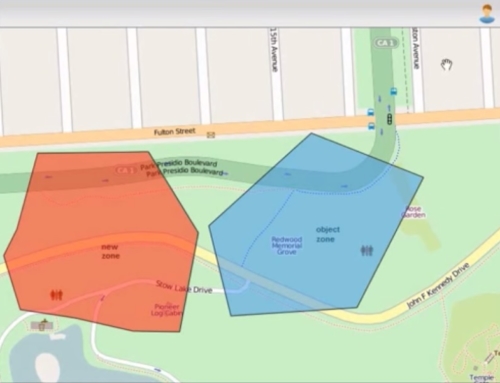

- Get your location listings in order. This is especially true of a rebrand/rename and when your institution has gone through an acquisition or merger. Beyond claiming the listings, use the description feature on Google My Business to share more about the name change after the rebrand or merger.

MOMENTUM

- Fire up the paid campaign. With any large change – such as a rebrand, acquisition or charter change – there should always be a paid media component to let the market know. One of the largest fallacies out there (and this is mainly for my credit union brethren) is that “opening the doors” with a charter change, merger or acquisition means people will perk up, take notice, and come to you in droves. Don’t let that be the case.

- Search Engine Marketing. Your market is going to be doing two things: some people will be searching for your old name or brand. Tell them about your new one. Other people will simply be searching for a financial relationship. Be in front of them.

- Display Banners and Social Media. If ever there was a truly effective “billboard,” display and social media campaigns are the equivalents of a digital billboard. By using them to start the buyer’s journey with awareness, you set up success later in the funnel.

- Video and Internet Radio. Working in conjunction with traditional media, delivering digital commercials on video and radio platforms allows you to better spread your brand messaging, to the target markets you want to reach.

- Create events. Where digital marketing and business development meet, you’ll find digital events. Promote these as part of your paid campaign as well as organically through social media channels.

RESULTS

- Phase in your approach. Understanding that branding – and brand awareness – as a whole comes in stages to your market, digital branding should take the same approach. For example, the “Awareness” stage of your digital brand campaign should largely be lacking in any direct call to action or hard sell. Therefore, to ensure positive marketing ROI is being achieved and you are seeing appropriate results, phase in your branding approach. MarketMatch recommends following the buyer’s journey and translating each step to digital tactics.

Has your bank or credit union recently gone through a big change or transition? How did you approach the market from a digital perspective? Share your thoughts in the comments!

Want to hear more about how MarketMatch approaches the digital branding process? Let us know!