Geofencing has long provided a unique way to geographically target an audience in the digital realm. Whereas most digital platforms allow you to geographically target a county, city, zip code, or radius around an address, geofencing lets the advertiser get even more granular.

In discussing an upcoming auto loan campaign with a client, we decided that geofencing would be a good tactic to use in this particular instance. During the discussion, a number of challenges were pointed out that limit how geofencing works and how much to invest in this channel.

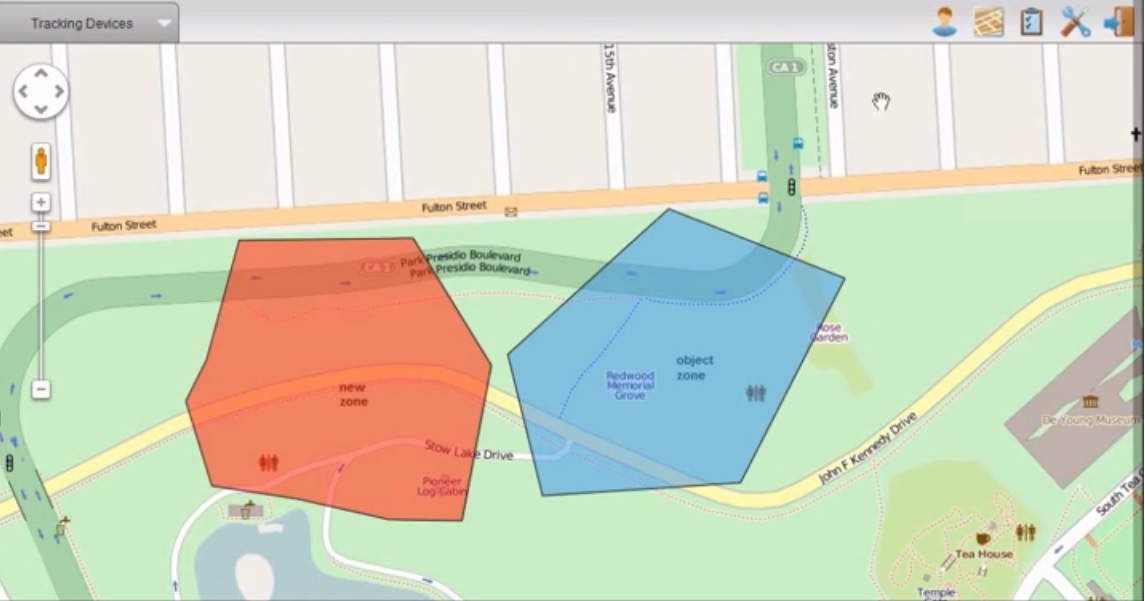

For the sake of this client’s campaign, we are using geofencing in order to target car shoppers on dealership lots around the FI’s branch locations. With geofencing, this style of granular targeting gets very easy! Simply switch the map over to satellite mode and geofence the car lot!

Here are some things to consider when geofencing to ensure you don’t alienate the audience and become too offensive with your advertising.

- Everyone Sees Everything. Obviously, the objective of an auto loan campaign is to generate more auto loans. And geographically targeting auto dealerships seems like a great place to get the right people. However, also consider that there is going to be a fairly large segment of the audience that is not there to buy a car. Most car dealerships today have large service departments. That means customers coming in to get an oil change will also fall into the geofenced area and get served your ads for auto loans. This can dampen the results of the campaign.

- The Creepy Factor. Much like setting up digital campaigns on Facebook or Google, geofencing platforms allow you to specifically target ads based on the location. Which means that, theoretically, you could target four separate car dealerships and create different ads to run in each geofenced location, specific to that dealership. One thing to consider: those ads, seen in the wrong light, could come across with a high creepy factor. It definitely puts the Big Brother idea above the radar.

- Friendly Fire. Remember, with geofencing, everyone in that fence sees everything. That includes employees of the dealerships that you’re targeting. Which means that the sales reps all the way to the finance guy stand a chance at seeing your ads. And if your financial relies on indirect auto loans as a source of loan volume, it might be best to make sure ads aren’t too forward in trying to compete with dealership loans.

- Timing. One of the bigger misconceptions with geofenced ads is understanding how the timing of the ad placement works. In our client’s campaign scenario, an optimal result would be to have the ad served, preferably by push notification, directly to the consumer’s mobile device as they walk into a car dealership. In actuality, ad placement takes longer than that with geofenced areas. In many cases, the ad won’t be placed until well after the consumer leaves the dealership.

With all of these concerns, it might be easy to write geofencing off as a tactic for your digital campaigns. However, with the right campaign and the offer, geofencing can work exceptionally well. Keeping in mind, of course, that geofencing is just one of the tactics that are a part of a campaign strategy, and not the only tactic you should rely on for success.