I wasn’t going to do it. I mean, the last thing I need is another credit card to keep track of. But, darn it, the allure and attractiveness of the Apple Card sucked me right in. The moment that email hit my Gmail inbox from Apple, I knew I had to apply.

Now, this isn’t going to be a post about how Apple is trying to change the credit card and payments game. Nor am I going to go talk about all of the features the Apple Card has. This is merely an example, much like last week’s post about personal loans, about how Apple has made the process of applying for, being approved for, and receiving a credit card simple.

From top to bottom, as long as your iPhone is updated to the newest iOS, here’s how easy it was to apply and get an Apple Card.

- Open up the Wallet app.

- Hit the “+” button to add a card.

- Select the Apple Card from the next screen.

- The first screen has you verify your name and date of birth. Apple didn’t know my date of birth, so I filled that in.

- The next screen has you verify your address, which fills in automatically if you already have Apple Pay set up.

- Next, you verify your citizenship and last 4 digits of your Social Security Number.

- Next, enter your estimated annual income.

- Accept the Terms and Conditions on the next screen.

- Processing…processing…processing.

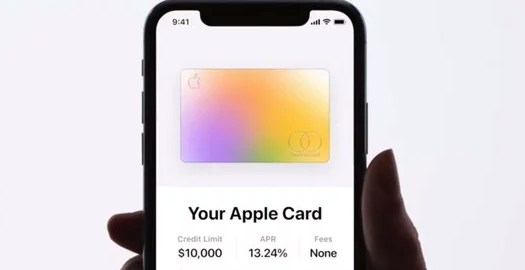

- The next screen presents you with your credit limit, APR and fees (if any).

- From there, you accept the card and add it to your Apple Wallet.

BOOM! Done.

This whole process took me under two minutes.

Two minutes! And the Apple Card is immediately ready to use with Apple Pay on your iPhone. In fact, I Door Dashed food last night with the Apple Card. And, lo and behold, my cashback appeared, just as it should, on my Apple Cash card this morning.

Beyond the ease of application and no need to fill in a lot of information (because Apple Pay already had it), the big thing that impresses me about the Apple Card is the immediacy of being able to use the card. Since the physical Apple Card that will arrive in my mailbox in 5-7 business days won’t have a physical number etched in it, it makes it easy for them to get you using the card sooner.

While there are obvious limitations with the way community financials issue and activate cards today, versus what Apple can do, it does spark conversation around how we can make changes to better compete. As usual, Apple is leading the way with innovation. Now it’s our turn to follow suit.