We learned from “You don’t compete with Wells Fargo’s customer experience, you compete against Amazon!” that, “78% of consumers who feel positively about a brand will stay with it, 81% will spend more on it, and 90% will recommend it to others.”

We also know that today’s consumer judges their experience with you based on their BEST experiences with someone else.

They don’t care that your $250 million institution has a fraction of Amazon’s resources – they expect you to keep up.

So, isn’t it interesting that we are “banking” our brand and reputation on third-party core technology that we have little or no control over?

So, isn’t it interesting that we are “banking” our brand and reputation on third-party core technology that we have little or no control over?

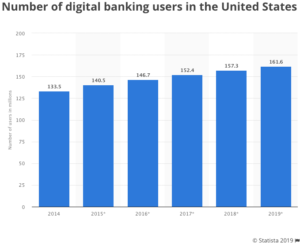

Through consumer need and bank’s focus, there are now 28 million more digital banking user than there were five years ago … that’s a 21% increase. If you’re going to be truly customer-centric, you must have the absolute best, easiest-to-use electronic access that you can afford.

But technology can’t be your only investment. If you’re going to put your money where your customer is, you have to invest in your people. After all, unlike your core tech, personal interaction is the only brand experience you can control.

With the move toward increasing electronic transactions, your personal interaction opportunities are shrinking like a Alice slurping down a bottle marked, “Drink Me.” You don’t have a single personal interaction to waste.

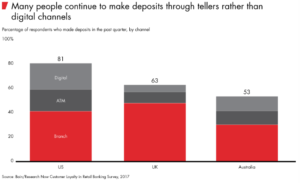

The good news is that, even with a 21% increase in digital banking, consumers still choose to make deposits through tellers more than digital or ATM options. So, there it is, your tellers are the key to your brand experience … great! But, in nearly every bank and credit union I’ve ever walked into, the teller is the least valued, empowered or compensated employee … crap!

The good news is that, even with a 21% increase in digital banking, consumers still choose to make deposits through tellers more than digital or ATM options. So, there it is, your tellers are the key to your brand experience … great! But, in nearly every bank and credit union I’ve ever walked into, the teller is the least valued, empowered or compensated employee … crap!

If you expect to have the best customer experience, you should plan on paying enough to attract and retain the best staff. Your teller don’t need to earn the same as your mortgage or commercial lenders, but if you’re going to put your money where your customer is, you have to take staffing seriously. Keep in mind, salaries aren’t your only consideration.

Where you can make an economical impact is in empowerment and communication.

Empowerment

You’ve hired mature adults. Now, expect them to act that way. By providing clear and sensible boundaries, you can allow your frontline staff to make more decisions. Empowering your team to make important decisions will make them feel more important and avoid the, “I’m just a teller,” syndrome. It will also increase customer satisfaction as issues will be handled more quickly.

Rather than micromanaging every interaction, and putting your staff in service straightjackets, you can hold weekly meetings to discuss what issues came up, how they were handled, the impact of the decision and possible recommendations for the next time the issue comes up. The most important resource in increased empowerment is training. If you entire team understands your company’s core intensions, they will act accordingly with your customer.

Will some mistakes be made? Sure.

Will you have a more engaged staff that eventually has a better understanding of how your institution works and how decisions impact the business and the customer? Absolutely!

Communication

Have your tellers ever seen your marketing plan? Shouldn’t they, they’re expected to execute on it?

Sharing your marketing plan with the entire team will allow everyone to better understand:

- Who is your primary target: All customers should be treated with love, but not all customers are created equal.

- Why: Your team should know why you have selected your primary target audience and what that audience is expected to bring to the institution. They may try a little harder to identify, acquire or retain that customer.

- Market research: Your staff should know how you compare to your competition. They should be able to compare and contrast you with the bank down the road.

- How will you reach them: Of course, your team should see any customer-facing communication first. But, do they understand how you are reaching your audience?

- What is your most compelling message: A brand has the “Brand Essence,” a product campaign has a “unique selling proposition.” After your customer sees a message in your marketing, can your staff define it at the point of sale?

Whether it’s Disney, Chick-Fil-A or USAA, the best simply do what they say they will. Training and an understanding of the corporate culture is expected all the way down to the least compensated employees. Every single team member is expected to deliver. In short, the very best put their money where their customer is.

SUBSCRIBE TO THIS FINANCAL MARKETING BLOG

Free Marketing e-Book

Free Bank & CU Marketing White Papers

Read Success Stories

See Our Videos

email me directly

937-371-2461

Follow us on Twitter @MarketMatch