What Google Trends Tells Us About Banks and Credit Unions.

SUBSCRIBE TO THIS FINANCIAL MARKETING BLOG

There are more than 3.5 billion Google queries per day. That’s about 40,000 searches per second. It’s no wonder that the Google overlords know everything!

Based on what people are searching on Google, we can tell if there is more interest in the Beatles or Rolling Stones (the answer is the Beatles, but there’s been a spike for the Stones since Jagger’s heat surgery). We know if more people search for beer or wine (it’s consistently wine – unless you’re in North Dakota, Vermont, Wyoming, Wisconsin or New Hampshire).

We can also tell how often people search key banking terms. We’ve used the power of Google trending to look at what is important in banking.

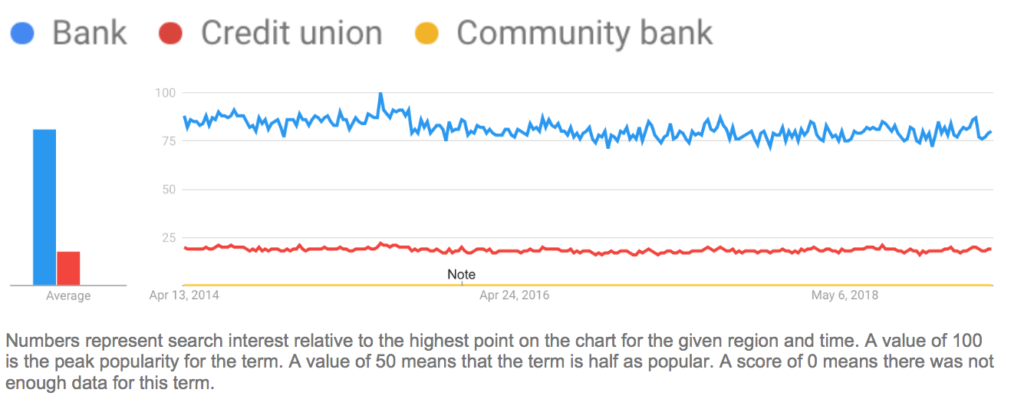

Banks Vs Credit Unions

If you’re a credit union, this looks bleak. People are four times more likely to search for a bank on Google. But, when you consider that credit unions only have about 8% of U.S. assets, this is actually pretty impressive. There is, however, clearly more work for credit unions to do when it comes to awareness.

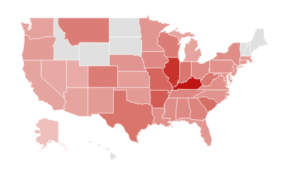

While banks dominate searches across the country, the strongest states for credit union searches were: Maine, Michigan, New Mexico, South Dakota and Rhode Island.

Now, if you’re a community bank who hangs your hat on being “Community,” pay attention. When it comes to searching online, a bank is a bank … whether you’re Chase or Main Street Community Bank, people are only searching for “bank.” Neither the terms “community bank” or “local bank” rated high enough in searches to have statistics nationally. The only two states that ranked high for “community bank” searches were Kentucky and Illinois.

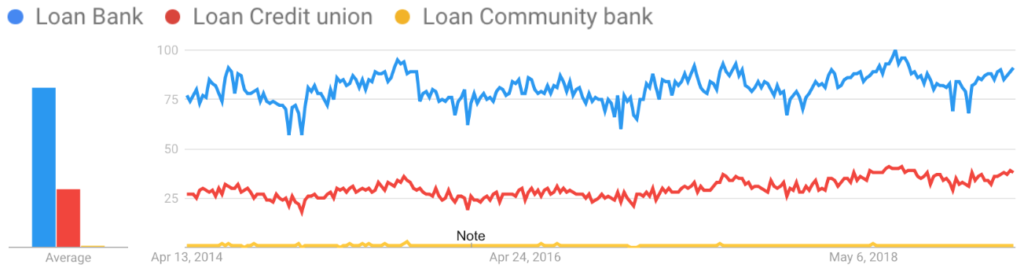

Loans

Banks continue to dominate when searching for loans, but credit unions are stronger here. If you are a credit union looking to expand membership, you may want to consider leading with loans rather than checking, particularly in Utah, Wisconsin, Alabama, Idaho or Michigan. In fact, credit union loans were searched more than banks in Utah!

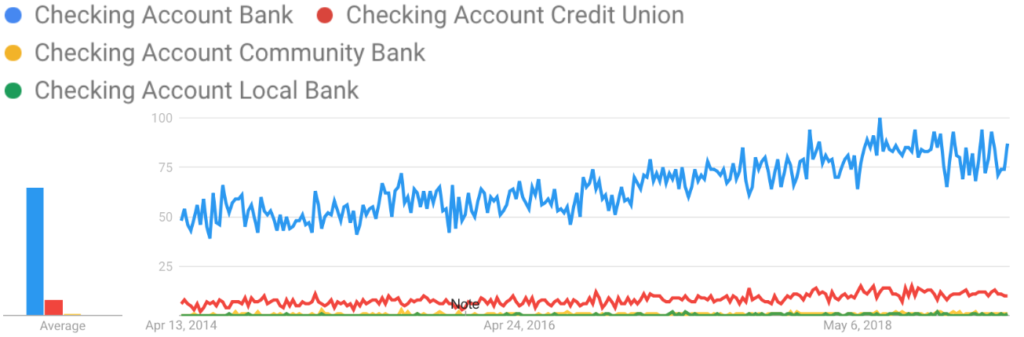

Checking

Credit unions are faring much worse with checking account searches.

With ongoing consolidation, quickly evolving technology and constant money in motion, there has been a positive 5-year trend for checking searches. In that time, banks have experienced the sharpest increase in market queries for checking.

When people are searching for bank checking accounts, a popular phrase is “free checking accounts near me,” and for credit unions, it’s, “best checking account offers.”

Access

The key to checking accounts is access. In fact, I argue that we shouldn’t even call them “checking” anymore. With some clients, we position these as Access Account.

Read: Why You Shouldn’t Sell Checking Accounts

When it comes to accessing money, “online banking” is king. Though online banking searches have been trending down for 5-years, they are still far more popular than checking, mobile banking, mobile check deposit or online bill pay (person-to-person didn’t have enough searches to register). After online banking, e-access interest ranks: online bill pay, mobile banking and mobile check deposit, respectively.

Loans

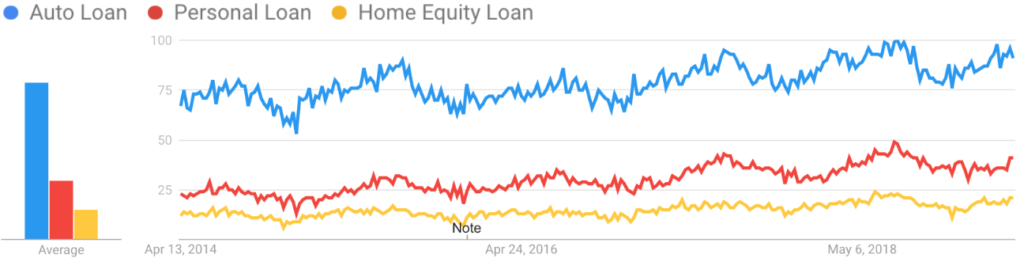

Among retail loans, it’s no surprise that auto loans lead the category followed by personal loans. Both auto and personal loans have seen increased interest over the last 5-years.

When searching auto loans, the top related search is, “auto loan calculator.” Make sure to include a calculator on your auto loan page.

Home equity has also seen increased interest, but overall is fairly flat.

Since April 2018, the five best states for home equity searches are: New Hampshire, Vermont, Massachusetts, Maine and the District of Columbia.

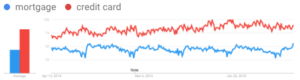

Without question, the most searched loan products in America are mortgages and credit cards.

Seemingly everyone wants a credit card … and the searches have only been growing for 5-years. If you can beat Capital One’s 15% interest rate, you should be out there telling everyone!

Seemingly everyone wants a credit card … and the searches have only been growing for 5-years. If you can beat Capital One’s 15% interest rate, you should be out there telling everyone!

We also uncovered an interesting trend in mortgages. Each year, mortgage queries are at their highest in January and tapper through the year. This has been consistent for four years … until 2019. Interest for home loans again jumped in January, but it has not yet tapered. In fact, mortgage searches are at their highest in 5-years. It is time to get your mortgage lender’s face into the community.

As with auto loans, “calculators” are the most related search to mortgages, make sure they are easily accessible from your mortgage page.

Google truly does know all. And Google trends should be a part of your marketing planning … or simply used to resolve any Beatles vs. Stones debates.

SUBSCRIBE TO THIS FINANCAL MARKETING BLOG

Free Marketing e-Book

Free Bank & CU Marketing White Papers

Read Success Stories

See Our Videos

email me directly

937-371-2461

Follow us on Twitter @MarketMatch