You’ve likely seen the headlines: FinTech companies are taking over the banking industry by storm. And while I’m not personally one to completely buy into the hype, there are certain areas where the hype has merit. One of those areas? The loan markets.

Specifically, the unsecured and home equity loan market. Traditional banks and credit unions are getting obliterated by solutions that appear sleeker, simpler and, well, more fun.

This all boils down to two primary areas of interest: digital marketing and branding.

Digital Marketing

No matter what your geography is, a simple Google search (or even Bing, should you be trying to escape the inevitable overtake of the world by Google) will reveal the stark reality of what FinTech is doing. They’re simply out buying every other lending solution in this market. But FinTech’s scope is limited.

They’re not concerning themselves with auto, boat, RV, credit card or other similar types of credit that require more work and upkeep. Even on the unsecured side of the business, the majority of FinTech firms are focused on debt consolidation as the “type” of loan they are selling.

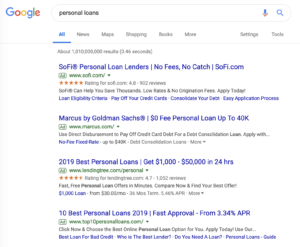

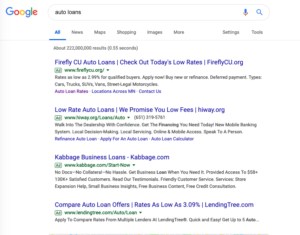

Take a look at the top results for a search in “Personal Loans” versus “Auto Loans.”

With personal loans, there isn’t a single community financial to be found in the paid search results. Auto loans, on the other hand, puts two local financials right on top!

There are two solutions to this predicament for community financials.

- Choose to compete on lending products that FinTech is not focused on.

- Focus on your target audience so specifically that you own what those people are searching for in order to compete.

Branding

The other big way FinTech is competing against ye ‘ol traditional banks and credit unions is with branding. While some FinTech lenders (SoFi, Prosper, Best Egg, etc.) are standalone entities that have put a warm, creative take on their brand, some financials have taken to spinning off FinTech lending divisions to better compete.

Marcus (by Goldman Sachs), LightStream (a division of SunTrust Bank), and Rocket Loans (by Quicken) are just a few examples.

Don’t all of those names sound…fun? It’s almost as if you want to jump right out to their well-designed and inviting websites and apply for a loan, even if you don’t need it!

But don’t let the creative names and awesome websites fool you. All of these lenders have the same, if not similar, underwriting guidelines that you do. They’ve all simply managed to mask this to the point that the consumer – YOU – believes that this getting a loan is the easiest thing since putting sliced bread in a toaster.

So, what’s the solution to this? Easy. Beat them at their own game. If you haven’t discussed spinning off at least one product in your lending division in order to broadly appeal to the mass market of consumers, it’s time to do so.

In fact, MarketMatch recently assisted a $250 million credit union do exactly that with their home mortgage division last year. The result? A fresh start with the market in terms of brand, and a loss of associating home loans with that credit union with the “ye ‘ol credit union” down the street.

Do I believe that most of what FinTech is doing is hype? Yes. But that doesn’t mean it shouldn’t be paid attention to and workarounds found.

Want help with a digital marketing or branding strategy to derail FinTech in your area? Drop us a line.