I support this idea with the notion that, in order for a consumer to consider you for a loan, they must first perceive you as a viable financial option. Put another way …

I have a theory, and I need your help!

In order to grow loans … focus on checking.

I support this idea with the notion that, in order for a consumer to consider you for a loan, they must first perceive you as a viable financial option. Put another way …

A consumer is more likely to consider their day-to-day transaction bank or credit union when they have a need to borrow.

Without top-of-mind awareness for loans, an institution, more likely, must compete on price to grow business. And in this rate environment, who wants that?

Now, keep in mind, at this point this is only a theory. But it’s backed with nearly 20 years of marketing experience, more then a decade of those in financial marketing.

The next step … As with any good theory, is to prove or disprove it. So I set about collecting data.

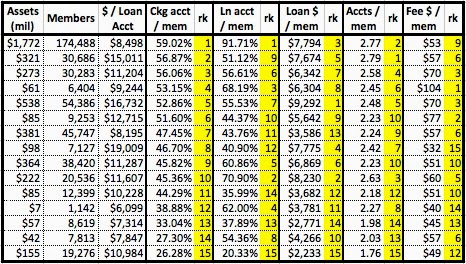

The chart below is data from 15 past and current MarketMatch credit union clients as well as a few key prospects. It was a way to take a fairly random sampling of institutions from all over the country with a wide asset range. In order to level the asset-size playing field, I looked at all key measurements on a “per member” basis.

The idea was to compare checking accounts per member against: loan accounts, average loan balances, total accounts and fee income to see if there is a correlation.

What did this exercise yield?

- There seems to be little correlation between asset or member size and Checking or Loan penetration.

- There is little correlation between Checking penetration and fee income. This was VERY unexpected.

- Credit unions with a better Checking penetration have more accounts per member.

- While those with the highest Checking penetration are more likely to have better Loans accounts and balances per member – but the correlation isn’t close enough to fully support my theory.

So what?

This is where I need YOUR help! This whole thing raised more questions than answers. In general, I’d say that those credit unions who cross sell well, do it across the board – it’s cultural.

I still don’t know if a checking account raises the probability of a member’s next loan coming to you. OR, does having a new loan raise the probability of getting their checking account?!?!

But, as we prioritize our 2014 objectives (and checking and loans is on many of your lists!!!) here’s something to consider:

If you need non-interest income, focus on checking:

- The top 5 CUs we looked in Checking penetration averaged $70.80/member in fee income. The bottom 5 averaged $48.40. A $22.40/member swing!

- The top 5 CUs for Loan penetration averaged $61.60/member in fee income. The bottom 5: $46.80.

Checking drives more accounts overall compared to loans (this may lend some weight to my checking driving loans theory):

- The top 5 in Checking penetration averaged 2.61 accounts per member

- The top 5 in Loan penetration averaged 2.47 accounts per member

I’d love your opinion on the theory. Am I brilliant, full of “it,” or completely wasting my time? Leave a comment on this blog or LinkedIn group discussion.

The end goal is to make smart prioritization of our budget. Lets face it, it’s not limitless. If you have $1 to spend, where are you going to focus? THAT is the question that drove this blog.

|

We bring these marketing philosophies to credit unions and community banks nationwide, and would love to bring them to your institution too. Contact us to see how.

With more than 280,000 visits worldwide, we hope that you enjoy this blog. If you find it helpful, please share it with your colleagues. Also, check out our YouTube Channel for short video blogs about financial marketing.

MarketMatch is also a nationally and internationally requested speaker. Contact us to bring our marketing ideas to your next conference.

|