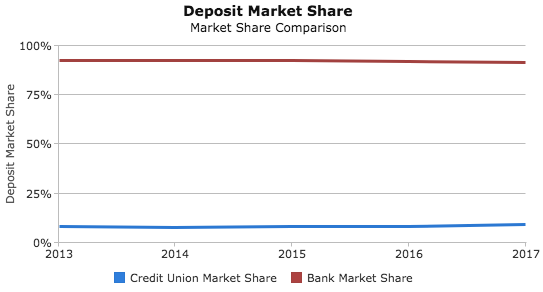

When I spoke in Michigan, last month, 35% of retail deposit market share in the state was owned by just three banks. By comparisons, all 252 credit unions, combined, had only 19%.

———-

When I spoke in Texas, a few months ago, 41% of the market share was owned by three banks. While the 506 credit unions had about 9.6% combined.

———-

This weekend, I speak in Utah where 49% of the state market share is owned by three banks. All credit unions in the state, combined, have a ridiculous 4.35% market share!!!

I don’t care what state you are in, there are three large banks that dominate the market share. And you are fighting hundreds of other financial institutions for their scraps.

If you are a credit union or community bank, you are struggling to stay relevant.

And how are you fighting? What are you saying about your bank or credit union that is going to make people drive by six competitors to walk in your front door?

- Free checking?

- We’re friendly?

- Great rates?

- Not for profit?

That’s nice. Do you know what those hundreds of other banks and credit unions are saying? They have free checking. They are friendly. They have great rates. If they are a credit union, they are not-for-profit.

I’m sorry, but as a consumer and as a brand marketer, I ask … SO WHAT?!?!

The days of playing it safe are over. From 2015 to 2016, there were 237 fewer credit unions and 228 fewer banks. You’re not just fighting for big bank table scraps, you’re not just fighting for new customers and members, you are fighting to stay alive!!!

Be Bold

From a brand perspective, if you chose to play it safe, you might as well take out an ad that you are looking to be merged.

You need to be different. You must provide a clear reason for someone to leave the big bank for you. Brands like Apple and Amazon did not get where they are by playing it safe.

Read more at:

Be Smart

Marketers love data! And who has more data at their fingertips than financial marketers?

Whether you have a CRM, MCIF, Automation Platform or just your core … dig into your data. Who uses each product? How do they use them? Who clicks your ads? Who visits your site?

We do not have Bank of America’s $2-billion ad budget, so we need to make every dollar count. Use your internal and digital analytics to be as smart as possible.

Read more at:

- 3 Easy Ways to Get More from Google Analytics

- Why Do you Have a Website?

- Tracking Conversions: It’s Marketing Success

- Acquisition So good, You’ll Need a Bouncer

Be Simple

You and I know that we live in a world of regulation. Don’t burden the customer or member with it!

I have a client whose corporate mission is to “make the financially complex simple.” I love that philosophy. They question EVERY perceived member hoop and try to find work-arounds.

You also need to make sure that you have all of the electronic access that people expect: P-2-P, mobile deposit, mobile pay, and whatever they will come up with tomorrow.

Read more at:

- Late to the Party: 4 things Your FI Needs to Compete on Today

- 5 Tips to Improve your Online Applications

Be Protective

Once you have the customer or member, you need to give them EVERY reason to stay with you. They are more valuable than whatever is in your safe.

Experience: Assign someone to be in charge of customer experience. They should be able to survey, analyze and recommend adjustments to your processes.

Communication: As long as it’s tasteful, you cannot over communicate with customers.

For example, reach out to people who have recently paid off loans. 31.5% will need a new loan within a few months and 68% of those go back to the same lender.

Read more at: