More and more, banks and credit unions are driving people to online account opening.

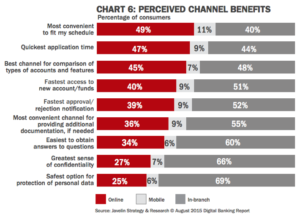

It’s vital that you launch, review and/or improve your online applications immediately as they are increasingly the preferred method for consumers. In 2015, 70% of consumers who planned to apply for checking said that they would have preferred to do so in digital channels*. Consumers said that they prefer digital channels because they are more convenient (60%) and quickest (56%)*. To that end, in the U.S., Mobile is used more than computers for digital bank transactions**.

It’s vital that you launch, review and/or improve your online applications immediately as they are increasingly the preferred method for consumers. In 2015, 70% of consumers who planned to apply for checking said that they would have preferred to do so in digital channels*. Consumers said that they prefer digital channels because they are more convenient (60%) and quickest (56%)*. To that end, in the U.S., Mobile is used more than computers for digital bank transactions**.

To get a handle on the trends and consumer perceptions, I turned to the August 2015 Digital Banking Report, Digital Account Opening.

Overall, we’re doing pretty good. 87% of consumers are able to open an account in one session. While only 8% abandon the online application process.

But, there is still a perception or fear that online is not as safe, with 69% of consumers saying that in-branch is the “safest option for protection of personal data”*. Education, communication and, well, actually keeping their data safe will help to move this perception in the right direction. Every positive online interaction will raise the confidence level in your online apps.

Of the accounts opened in 2015, the following were digital:

- Checking: 49%

- Savings: 52%

- Auto Loan: 58%

- CD: 59%

- Mortgage: 66%

- Retirement: 69%

- Brokerage: 70%

- Educational Accounts: 72%

- Credit Cards: 77%

Source: Javelin© August 2015 Digital Banking Report

We can only assume that those numbers have increased in the last two years. How do your online account opening stats stack up?

While we’re doing a good job opening accounts, we’re still losing about 8% of our online opportunity.

Reasons why consumers abandon online checking account applications:

47% Decided that they didn’t need the account after all

12% The process was too complicated

10% Applicant couldn’t satisfy minimum deposit requirement

9% Process was too long

6% Institution wanted documents that the applicant didn’t have

4% Applicant couldn’t get answers to their questions

12% OtherSource: Javelin© August 2015 Digital Banking Report

I personally have a hard time believing that people research your product and click the “Apply Here” button, then 47% suddenly change their minds about the account. But, taking the data as is, 31% of those that abandon your online application are frustrated with its complexity, length or your institution’s communication.

What can you do to improve your online application experience?

5 Tips:

- Are your online applications mobile optimized? They need to be.

- Apply for products with your competition. Are they faster? Easier? Do they look better? Does it take fewer clicks? If so, update your process.

- At every step of an online process, your customer should be able to easily get a question answered. Can they?

- Online doesn’t mean “No talk.” What are your offline procedures to online applications? Are you following up with a phone call to begin building a relationship?

- Educate your consumers on the safety of your online applications. What makes them safe? How many people successfully use them? Ease their concerns and tout the convenience and speed benefits that they want.

* Source: Javelin© August 2015 Digital Banking Report

** Bain & Company© August 2015 Digital Banking Report

Love this financial marketing blog?

Get the book! Click here to download “Aha Moments,” our

FREE ebook, chock-full of 80 short articles just like this.

In addition to being a strategic consultant for community banks and credit unions, MarketMatch also has nationally and internationally requested speakers. Contact us to bring our marketing ideas to your institution or next conference.

email me directly (click)

937-371-2461

Follow us on Twitter @MarketMatch