The strong get stronger and the weak get gone.

Lets please have a moment of silence. While you’re reading this, another bank or credit union has left us.

We have more than double the deposits going into half of the institutions. And YOU, my friend, are reading this from your bank or credit union, so congratulations … you must have doubled in size, right?!?!

The strong get stronger and the weak get gone.

Lets please have a moment of silence. While you’re reading this, another bank or credit union has left us.

When I got married in 2000, my wife and I had 10,684 credit unions in the U.S. to choose from to consolidate our checking accounts. Last year, there were only 6,513. The numbers are roughly the same for banks.

In 2000 total deposits in U.S. banks totaled a bit more than $4 trillion – now, nearly $11 trillion (35% held at JP Morgan Chase, Wells Fargo, Bank of America and Citigroup).

So, we have more than double the deposits going into half of the institutions. And YOU, my friend, are reading this from your bank or credit union, so congratulations … you must have doubled in size, right?!?!

So, we have more than double the deposits going into half of the institutions. And YOU, my friend, are reading this from your bank or credit union, so congratulations … you must have doubled in size, right?!?!

In 2014, we lost 282 credit unions, about the same on the bankside.

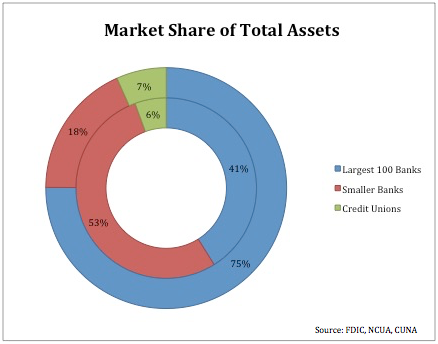

That’s roughly 600 dead institutions or about 1 1/2 a day! And who’s benefiting from this consolidation? The Largest 100 Banks!

In 1992, the largest 100 American banks owned 41.10% market share, today about 75.10%!

Smaller banks plummeted from 53.30% to only 18.20% market share in the same timeframe. And credit unions held steady growing by about 1%.

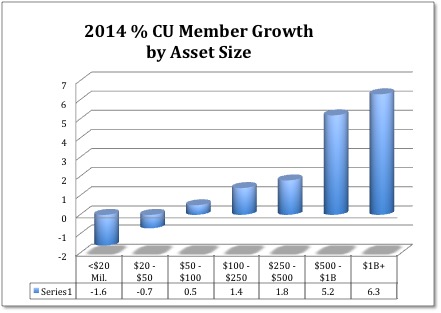

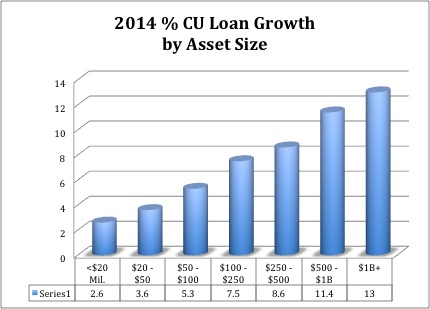

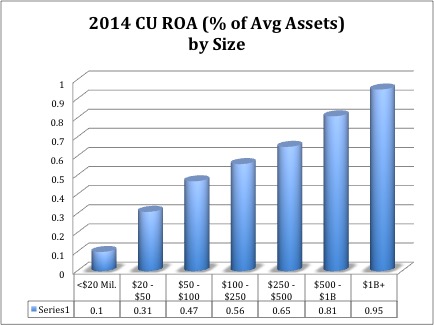

If we just focus on credit unions, you can see a clear trend. And it’s all in economies of scale.

The larger you are, the easier it is for you to grow and the cheaper it is for you to make money.

Source: NCUA & CUNA

3% of banks and 50% of credit unions have $25 million or less in total assets. These are the folks at the greatest risk. I can’t think of a clearer case for the ol’ cliché, “If you’re not growin’ you’re dyin’.”

As you head into your 2016 planning, what is your growth strategy? Organic or Acquisition?

Who will you steal market share from? The big banks with 75% market share, all of the market awareness and none of the service? The smaller banks who have lost 35% of the market share in the last 20 years? Or credit unions who are growing at an astounding 1%?

For more articles to get you ready for strategic planning check these out:

Marketing’s Vital Role in Strategic Planning

I know I’m biased, but the Marketing Department, in my opinion, plays the most important role in your upcoming Strategic Planning session.

FOCUS, Momentum, Results

On any given day, there are a million strategies that you can focus on. The trick is to identify the handful of strategies that you should focus on.

If you find it fun and helpful, please share this blog with your colleagues. Also, check out our YouTube Channel for short video blogs about financial marketing.

In addition to being a strategic consultant, MarketMatch is also a nationally and internationally requested speaker. Contact us to bring our marketing ideas to your institution or next conference.

See our story here. (click)

Or email me directly (click)

937-371-2461

Follow us on Twitter @MarketMatch