We’ve had some fun digging into the 2015 Growth Strategy Survey results from Bank Director. But there are also some great questions to be asked of the response results.

Here at MarketMatch, we’ve had some fun digging into the 2015 Growth Strategy Survey results from Bank Director. There are some fabulous insights that can be gained and nuggets of information in that report!

As I was taking in the results, a question regarding unregulated nonbank competitors and the results that it garnered stuck out to me.

Which of the following unregulated nonbank competitors do you worry about the most? (Respondents were asked to select all that apply.)

- Apple: 40%

- Wal-Mart: 34%

- Online/P2P lenders: 32%

- Google: 32%

- PayPal: 29%

- I don’t worry about unregulated nonbank competition: 25%

Okay, I’m going to stop right there.

Only 25% of CEOs, Bank Directors and Chairmen are NOT worrying about the list above?

My take: We need to focus where our worries are. Those 25% are exactly right – you shouldn’t be worrying about those unregulated nonbank competitors! And here’s why.

Apple

As far as I can tell, Apple’s foray into the financial marketplace with Apple Pay stands only to enhance the ways in which your customers or members can use your debit card. What’s so bad about that?!

I mean, I get the whole “our brand will not be top-of-mind” since the physical card will cease to be used…but in reality, at this point, aren’t most of us offering customized debit cards so that our customers can look at pictures of their kids or dog while they’re paying for something?

Your biggest threat with Apple Pay…would be an increase in interchange fees. Ouch!

Wal-Mart

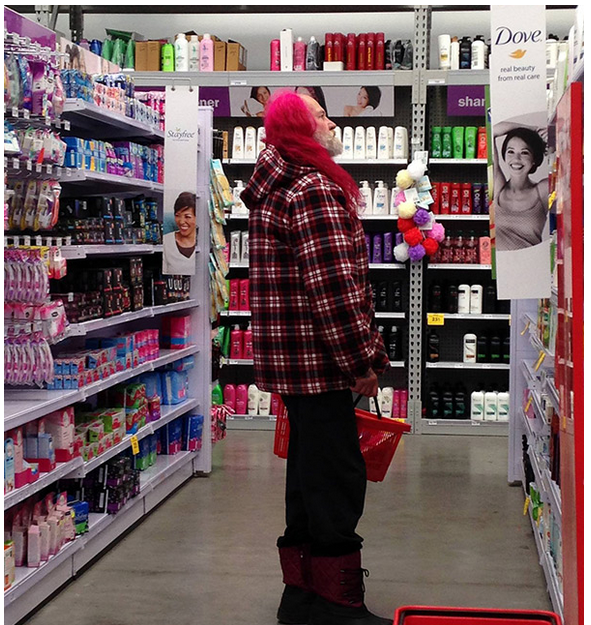

This one really threw me. So we’re saying 34% of CEOs and Bank Directors are worried about losing out on customers such as these??:

(Courtesy PeopleofWalMart.com)

Enough said. I think this one speaks for itself. (Although that last dude looks pretty cool.)

Do you simplly want branch transactions, or credit-worthy borrowers and high-depositors?

Online/P2P Lenders

I see the fear in this one more than ANY of the others. However, customers who are attracted to these types of lenders typically are either:

- Unable to qualify for a traditional loan at your bank or credit union and will pay higher interest with a P2P lender, or

- Taking out a loan small enough that it would barely cause a blip on the bank’s radar screen.

My personal feeling is that the real takeaway here is that your bank or credit union needs to act “more socially responsible” to attract these customers back to your institution.

But, at the end of the day, nobody’s getting a home loan (or auto loan) from a P2P lender. End of story.

Google, for the most part, falls into the same category as Apple. Yes, your customers are going to use them to pay for things. BUT, they still need to use you as a home base of financial activity to support Google Wallet.

Until Google announces they’re going to open an actual bank with actual accounts, I’m putting this one on hold. And if Google does indeed do that, they cease to become unregulated and have to play by the same rules as everyone else.

PayPal

Apple, Google, PayPal. Rinse and repeat.

Maybe it’s my “2000 was only, like, 5 years ago” mentality, but PayPal is still synonymous with eBay in my mind. PayPal “coulda been a contenda. A BIG contenda.” Instead, somehow, they’ve missed the trend on being the first into the device payment game and let Google and Apple play their trump cards. If PayPal isn’t careful, I would venture a guess that they risk becoming irrelevant.

Sure, there were a few other unregulated nonbanking competitors on the list, but I think we all get the point. So, unless you are in the 25% of those that answer that question “I don’t worry about unregulated nonbank competitors,” chances are pretty good that you still don’t have much to worry about.

It’s always good to keep these nonbank competitors on the radar – certainly as part of your yearly SWOT analysis – but at this point, let’s all take a chill pill and keep on keepin’ on – because we’ve got nothing to fear but fear itself.

Want to know more about what makes MarketMatch tick? Check out our YouTube Channel for short video blogs about financial marketing, or contact us about speaking opportunities to bring our marketing ideas to your next conference.

937-856-1399

Follow me on Twitter @agregersonMM