The branding bug is clearly buzzing!

In the last few weeks, we’ve had a few community banks and credit unions reach out to us about rebranding. This week, I’ll react to the trend and discuss when you should consider a rebrand.

Your brand is your bank or credit union’s personality. It is the set of values that you live by. It is what you do whether people are watching or not. It is the first thought people have when they hear your name or see you. It is the feeling they get when they walk into and leave your branches. It is the staff culture that you nurture.

A brand must differentiate you from your competition. It must speak to your core audience’s wants and needs. It must allow you to grow and evolve.

But sometimes competition changes. Branches are built and vacated. New technologies emerge to threaten your business. Sometimes your audience changes. Market demographics can follow new or departing companies. People mature and move from one life stage to another. Sometimes, you change. You may grow and evolve beyond your defined brand.

Just as you are likely not the same person you were five or ten years ago, your brand may also need to shift to align with who your institution is today.

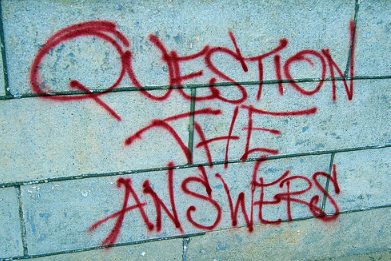

When you think about your brand, ask yourself these questions.

-

Does your brand tell a unique story about you?

People react to a good story. And they choose you over your competition because something about you is different and better. Can you clearly define that story?

-

What is your current brand equity?

What is your target’s awareness of you and do they understand your story? Do they “get it” at first glance? Is your story differentiating?

-

Is your current brand limiting?

Are you seen as a retail or commercial institution when you are truly much more?

What about your name? Many “Teachers Credit Unions” are now open to the community, but the name wouldn’t suggest it. Many “Bank of Small-Towns” have grown to markets well outside of the original Small-Town.

-

Do you have control of your current brand?

This is more prominent with credit unions. Delta Community Credit Union and Coca-Cola Credit Union, for example, have clear outside influences to their brand. Could you imagine if there was a Nike Credit Union? Think about the blow-back they would have this week in the heat of the Colin Kaepernick campaign launch? A campaign they would be tied to in name only.

Has there been a recent merger? Has that merger permanently affected the corporate culture? Did that merger bring a new audience with it?

-

Is your brand still relevant?

- Does it still define who you are?

- Does it reflect your values?

- Does today’s corporate culture still reflect your brand?

- Does the brand allow you to evolve into what you want to be?

- Is it outdated in graphics or message? Are you embarrassed by your marketing?

- Has your target market changed? Market demographics, shifts in strategic focus and new products can all influence today’s brand relevance. Are you in any new markets?

If you’re feeling a bit squeamish after reading through any of these questions, it may be time to seriously look at your brand. Put your bank or credit union on the therapist couch and try to rediscover who you are.

Read More:

- Branding Without Limits (White Paper)

- 25 Questions to Answer Before You Rebrand

- Understanding Rebranding Risks

- The “I don’t love it, but maybe it’ll grow on me” Brand

- Mold Your Brand to These Millennial-Favorites

Love this financial marketing blog?

Get the book! Click here to download “Aha Moments,” our

FREE ebook, chock-full of 80 short articles just like this.

In addition to being a strategic consultant for community banks and credit unions, MarketMatch also has nationally and internationally requested speakers. Contact us to bring our marketing ideas to your institution or next conference.

email me directly (click)

937-371-2461

Follow us on Twitter @MarketMatch