I just finished another round of branch experience shops. This time, in Central Michigan. I walked into 18 branches in four small cities to see how each presented themselves in service and sales process.

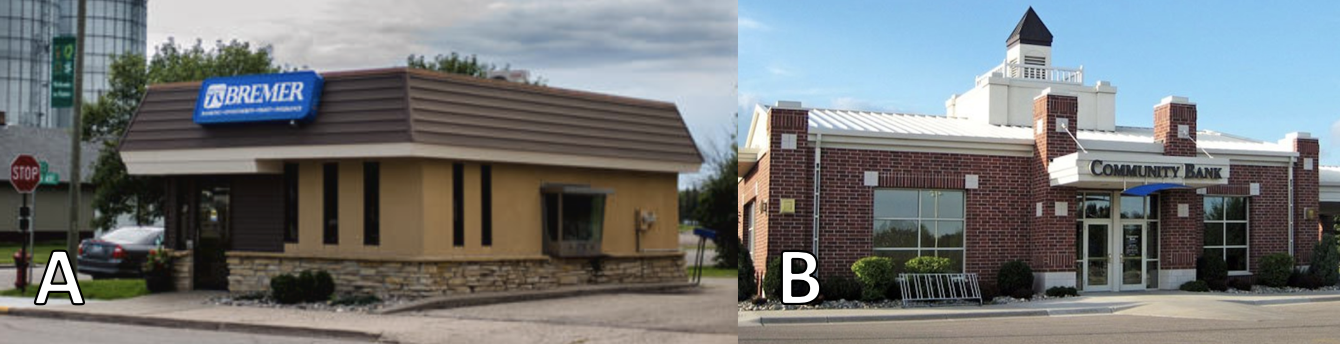

In one particular city, the worst looking, most out of the way, most poorly branded branch had a line that was four people deep when every other bank and credit union in town was empty. It was a dramatic example of customer purchase decision making and why you need to understand what makes your market tick.

Wouldn’t it be great to ask…

- All things being equal, which branch would you rather bank with?

- If option A provided lower fees, which would you choose?

- Which would you assume has the more robust online banking?

- If option A had a friendlier, more helpful staff, which would you choose?

- If option A was closer to your home or offered more physical locations for you, which would you choose?

- Which would you assume has the better mobile app?

- Would you choose the institution with staff that smiles, makes eye contact and talks to you or one that is all business?

- What if option B, with the friendlier staff, was slightly costlier or had marginally worse rates, who would you choose?

- What if the less friendly staff was:

- More convenient?

- Had better electronic options?

You can only select one … Do you want the financial institution that provides the:

- Best rates?

- Most physical locations?

- Most ATMs?

- Best online banking?

- Best mobile app?

- Best checking options?

- Most helpful staff?

- Nicest looking branches?

- Lowest fees?

- Easiest and fastest electronic applications?

- Best community image?

- Best reputation?

The branch experience shops are designed to identify the strengths and weaknesses in a client’s sales and service culture so that they can focus procedures and training in areas that will differentiate them from the competition.

A better trained, more motivated staff will increase services and balances per customer. They will also help to increase retention and bring in new customers through word-of-mouth.

But, your staff can only do so much. You need to attract the business to give your staff more “at bats.” To better draw in the community, you need to understand what is most important to your market. Better yet, what is most important to your primary target … the few personas, who live in your market, that you most want to attract. When you understand what your audience most wants, you can position yourself in a way that will draw more people to you … even if you have an ugly, out of the way branch.

Love this financial marketing blog?

Get the book! Click here to download “Aha Moments,” our

FREE ebook, chock-full of 80 short articles just like this.

In addition to being a strategic consultant for community banks and credit unions, MarketMatch also has nationally and internationally requested speakers. Contact us to bring our marketing ideas to your institution or next conference.

email me directly (click)

937-371-2461

Follow us on Twitter @MarketMatch