The days of dressing up in a suit, heading down to the bank and securing a personal loan and a trusted firm handshake are as outdated as girdles and ascots.

Companies such as LendingClub, Kabbage and Prosper have created a model where individuals can earn interest by lending money to other individuals. It almost sounds like the old credit union story:

“We started by keeping deposits in an old coffee can that was locked up in Agnes’ desk drawer. Folks would come down on payday, to make deposits and ask for loans. We have the original ledger framed in the Board room.”

Someone needs a loan. Someone has money to invest. One peer lends to the other with the lending peer earning interest. The Fin Tech company then earns a fee for brokering the deal.

The biggest difference, now, is that peer-to-peer lending is much faster. You can invest in or apply for a loan on your smartphone 24-hours a day. And what demographic would you think this is attracting?

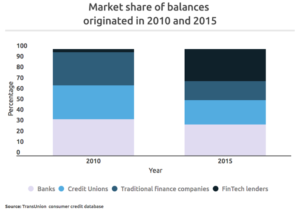

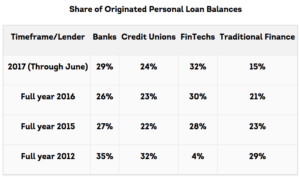

Fin Tech has been gobbling up market share since 2010.

Personal loan total balances and consumer participation have both grown considerably. As of Q2 2017, 16.1 million consumers possessed a personal loan, compared to 14.8 million in Q2 2016 and 13.1 million in Q2 2015. Just five years ago in Q2 2012, approximately 9.8 million consumers had a personal loan. Total outstanding balances have risen from about $45 billion in Q2 2012 to $106 billion in Q2 2017.

Source: TransUnion

This model works because the Fin Tech companies provide faster:

- Application

- Approval

- Funding

Most can approve and fund a loan in less than 24 hours.

What Can You Do To Compete?

Set a Limit: Most Fin Tech companies cap their loan amounts at $35,000. You may be stretching your underwriting limits a bit in the interest of speed and customer ease, so test the process with smaller loans at first.

Simplify the Application: First, you MUST accept applications online. But this offering may need a more streamlined alternative to your core-provided online loan process. Look at applications on Prosper or LendingClub (in my opinion these are two of the best).

All LendingClub asks for is:

- Loan Amount

- Purpose of Loan

- Name

- Date of Birth

- Home Address

- Individual and household income

- Email address

Since we’re not asking for any super-secure information, these applications can easily be an online form that emails to your underwriter directly … avoiding the more cumbersome traditional online loan application program.

Also Read:

Automate Wherever You Can: Since you have a limit on these loans, you can feel a little safer pushing for faster underwriting. You will best know your capabilities, but I would suggest that you get together with Lending, IT and Marketing to brainstorm the fastest way to approve these loans.

Combine Your Deposit Services: One huge difference between you and peer-to-peer lenders is that you have DEPOSITORS and P-2-P has INVESTORS.

You should offer an Investor section of your dedicated web page to talk about:

- How a customer’s investment can help a local family get a new car or help grow a local small business

- How invested dollars stay local

- The interest range that can be earned with your CDs

Honestly, the Fin Tech model isn’t new. They don’t play under a different set of rules. They simply have technology on their side. Something that we can easily catch up to if we’re willing to not do it like it’s always been done.

Love this financial marketing blog?

Get the book! Click here to download “Aha Moments,” our

FREE ebook, chock-full of 80 short articles just like this.

In addition to being a strategic consultant for community banks and credit unions, MarketMatch also has nationally and internationally requested speakers. Contact us to bring our marketing ideas to your institution or next conference.

email me directly (click)

937-371-2461

Follow us on Twitter @MarketMatch