Online account opening is faster, fits your market’s schedule better and is ultimately cheaper for your bank or credit union.

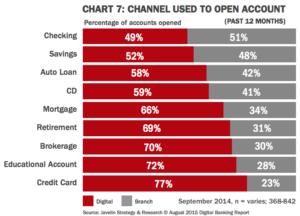

In the past 12 months:

- 77% of credit cards were opened online

- 66% of mortgages were opened online

- 58% of auto loans were opened online

- 49% of checking accounts were opened online

But not everyone who clicks your application is opening the product.

8% of consumers abandon online checking applications. Of those, 21% drop off because applications are too complicated or the process is too long (Javelin Strategy & Research© August 2015 Digital Banking Report). This compares with 27% of online retail consumers who abandoned because the process was too long or complicated (baymard.com/checkout-usability, 2016).

Don’t abandon your abandoned applications.

Retail email notifications about abandoned carts have a 40.5% open rate (eMarketer, 2015). We should treat our abandoned online apps the same way that Amazon treats you when you log out with an item in your shopping cart.

Stay on them until they buy, die or file a restraining order!

It may take some work with your core processor, but consider asking for daily data pulls of abandoned applications and reach out through text, email and phone call until they come back to complete the paperwork.

Your abandoned apps could be more valuable than the ones that flow smoothly. They provide an opportunity to learn and improve. Find out why they walked away without pressing “submit.” Did they run out of time? Get overwhelmed? Frustrated? Then work to correct the issues.

Your marketing has already worked to make these folks aware and motivated. It should be cheaper and easier to convert a discarded application into a sale than investing in a new un-initiated prospect. Treat this segment like the gold that they are.

Click Here to Read More: 5 Tips to Improve Your Online Applications.

Love this financial marketing blog?

Get the book! Click here to download “Aha Moments,” our

FREE ebook, chock-full of 80 short articles just like this.

In addition to being a strategic consultant for community banks and credit unions, MarketMatch also has nationally and internationally requested speakers. Contact us to bring our marketing ideas to your institution or next conference.

email me directly (click)

937-371-2461

Follow us on Twitter @MarketMatch