I like to think that I’m not the kind to stereotype, but…

Millennials, what the WTH?!?!

Alright, that’s the LAST time I’m using the “M Word.” It’s offensive.

But, the fact is that there are more than 79-million people in the US that are age 18-36, right now! That’s larger than any other age segment. Given their age, these are mostly folks that are starting, or early in, their career. They have increased responsibilities, income and expenses. Many are starting families. In short, they are the most likely age group to be experiencing the major life events (graduation, marriage, children, new home, entrepreneurs) that generate the most financial need.

But, the fact is that there are more than 79-million people in the US that are age 18-36, right now! That’s larger than any other age segment. Given their age, these are mostly folks that are starting, or early in, their career. They have increased responsibilities, income and expenses. Many are starting families. In short, they are the most likely age group to be experiencing the major life events (graduation, marriage, children, new home, entrepreneurs) that generate the most financial need.

I don’t want to stereotype, folks, but as community banks and credit unions … we NEED these people! We always have needed this age segment, it’s just that now there’s a bunch of ‘em.

That said, any decent marketer will start to dig into this group’s psyche. But be careful of the research you read.

Millenni … oh wait, “this age group,” SAYS that they hate big business and corporate America. In fact, they listed all four of the nation’s largest banks among their LEAST LOVED brands.

So, it should be easy, as community banks and credit unions, to acquire this cherished demographic, right? Not so fast. What they say and what they do, don’t jive.

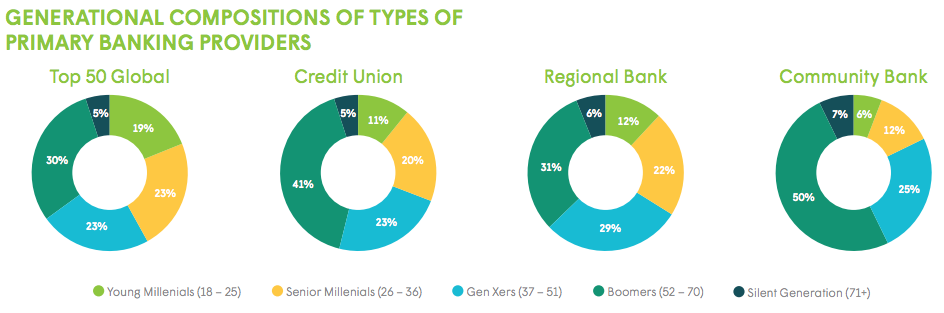

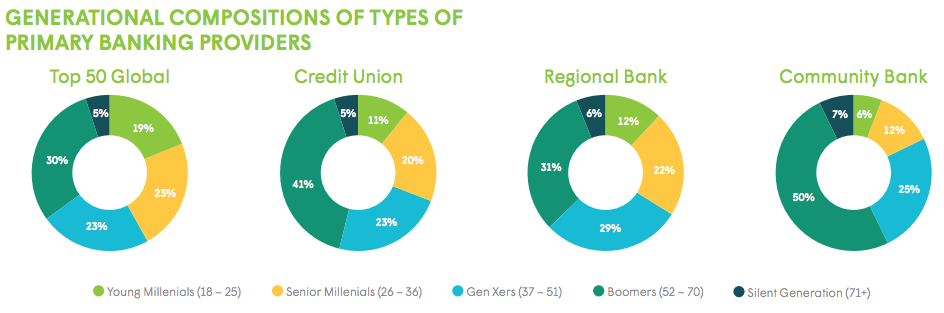

The 2017 FIS Consumer Banking Pace Report shows that those aged 18-36 account for 42% of big bank customers. But, only 31% of credit unions and a woeful 18% of community banks!!!

Wait, what? You hate the big banks, but chose them over community banks and credit unions? I ask again, WTH?!?

What do we need to do to attract a demographic that says they should prefer us, but don’t choose us?

AWARENESS

Some key statistics from The Financial Brand’s, “What Motivates Millennials to Switch Bank,” may hold the answer to how the M-word thinks:

- 82% say they are familiar with national megabanks

- 56% are familiar with local credit unions

- 51% are familiar with local community banks

- 82% say they are open to switching

- 61% would consider switching to a smaller community institution

- 83% say they would switch for better rewards

- 93% say no-fee banking is important

- 90% say convenient location is important when choosing a financial institution

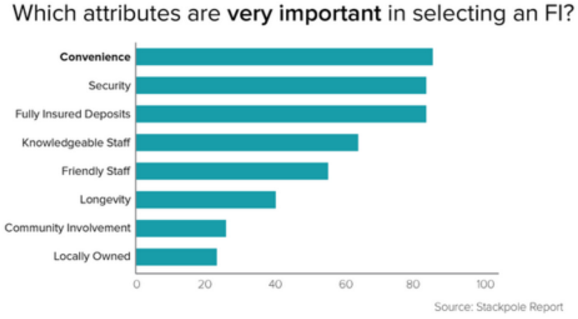

Never make a decision on one source. Check out these results from Stackpole Report:

THE BOTTOM LINE

We all want to say that we support local, and today’s young adults are no different. But, convenience is key. Practicality will often win out over ideology, and these studies seem to prove that out.

SO, WHAT CAN YOU DO?

Think small. Since convenience is key, it makes little sense to target those who need to drive past six competitors to get to you.

- Map out your competition

- Map out your existing customers

- Further narrow your target based on behaviors and interests

Once you have your tightly defined target, make sure they are aware of you! Remember, only about 50% know you exist.

The tighter you can make your target audience, the better you can compete with “the big boys” marketing budgets. You don’t need to seem HUGE to everyone, you simply can’t afford to. But, you can seem huge to the 10% of your market that you really want!

- Market where they live, work and play

- Make your marketing as engaging as possible

- Don’t tell them about your products. Tell the how you can affect their life stages

- Measure everything and adjust budgets accordingly

Look at it this way, you’re doing them a favor. This poor group is clearly banking with companies that they hate. We don’t want that for them, right? So, go get ‘em.

Make them aware of you! Let them know you are in their back yard. Let them know that you have fewer fees – and maybe even rewards. Remember, their life is changing in meaningful ways. Talk to how you can help them. And for goodness sake, don’t try to get them all! Be smart with your marketing budget.

Love this financial marketing blog?

Get the book! Click here to download “Aha Moments,” our

FREE ebook, chock-full of 80 short articles just like this.

In addition to being a strategic consultant for community banks and credit unions, MarketMatch also has nationally and internationally requested speakers. Contact us to bring our marketing ideas to your institution or next conference.

email me directly (click)

937-371-2461

Follow us on Twitter @MarketMatch