The checking account. The holy grail of the consumer financial relationship. The account that opens doors to very broad and profitable relationships with your consumers. Not to mention, checking accounts provide your bank or credit union with the added bonus of a branding opportunity every time one of your customers or members reaches for their wallet and pulls out a debit card to pay for something.

Debit cards have long been the most preferred method of payment among consumers (when choosing between credit, cash or debit). These cards, and the checking accounts that they are tied to, helped foster the term “primary financial institution” (PFI) and drive the consumer mindset that “your bank” is where your checking account is located.

Until this past year.

Credit Culture

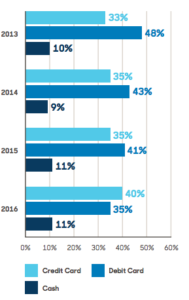

For the first time since the study has been conducted, the 2016 U.S. Consumer Payment Study found that consumers are showing more preference in using a credit card rather than a debit card or cash. Here’s the breakdown from the past four years of the study:

As you can see, in 2016, credit cards overtook debit cards for the first time as a preferred payment method by five percentage points. The responses were essentially flipped just the year before!

On the face of it, this has the potential to create a branding crisis for financial institutions, whereas consumers are no longer pulling their checking account debit card from their wallet. At it’s very worst, losing the debit card/credit card battle may very well lead to a loss of PFI status.

Not convinced? The 2017 FIS Pace Report tells us that only 17% of community financial institution consumers hold a credit card from their financial. The remaining consumers either do not have a credit card at all or hold a card from another financial.

A 17% credit card penetration rate among community financials is a weak spot against the national average of 42%.

The more we focus on checking accounts and debit cards as the key to PFI status, the further away from market trends we get.

What’s Changed?

Arguably, one of the largest changes in recent years has been the shift from a “top of mind” or “top of wallet” mindset to “top of phone.” The importance of having digital payment options for consumers continues to increase across all generational segments (up an average of 8.5 percentage points across the generations). I would also argue another angle. As consumers shift more of their payment preferences to digital wallets, there is a psychological drift to use credit – and thus, credit cards – more than debit card options.

Additionally, factors such as the rise in consumer fraud and security breaches, cash back rewards programs and heavy marketing from card companies have swayed consumer mindsets. All of this has shifted focus on credit cards as the primary financial relationship.

But credit cards are a product. Not a financial institution.

Simply put, the top of phone movement has changed the way the fastest growing segment of consumers think of their primary financial institution. No longer is it the place where all of the accounts are kept. It’s the card they use at checkout or the app that provides them with the most financial function. Checking accounts have become a place to pool money and pay the credit card bills.

Stay Competitive

Think about the app-based financial tools available to consumers such as Simple, Go Bank, Stash and Clink. Not one of these would be defined by traditional standards as a financial institution. Yet, if someone uses Simple or Go Bank as a way to access money and pay, or Stash or Clink as a means to save money through credit card purchases, these tools (or rather, accounts) can be seen as their PFI.

As community financial institutions, we need to stay competitive about our PIF status. If credit cards are the new harbinger of that status, here are three things your bank or credit union should look at to stay top of phone:

- Strong rewards. Study your market. Find out what your consumers value. Is it a rewards points program? Cash back? Low interest rates?

- Fraud protection. I know, it’s not sexy. But consumers are legitimately fearful of being subjected to consumer fraud. Show them you care about them if something were to go wrong.

- An excellent mobile app and digital wallet payment access are just the beginning. Dig into all fintech you can find to make your credit card the best product on the block.

I truly believe that the way consumers think about their primary financial institution will continue to evolve. As the Millennial generation ages and evolves their habits, the generation following is showing a completely different way of managing money. As financial marketers, our job now becomes to stop measuring PFI status the same way we always have.

Want to talk more about the future of payments? Drop me a line or comment below!

In addition to this blog, MarketMatch offers a great speaking session on payments, ready for your next conference or training session. Available in formats ranging from one hour to a full day session, attendees will leave feeling prepared to tackle their brand.

Email me to get started

937-856-1399