If you are merging with another institution, here are a few things to consider, from a marketing perspective:

- Brand Equity

- Retention

- Acquisition

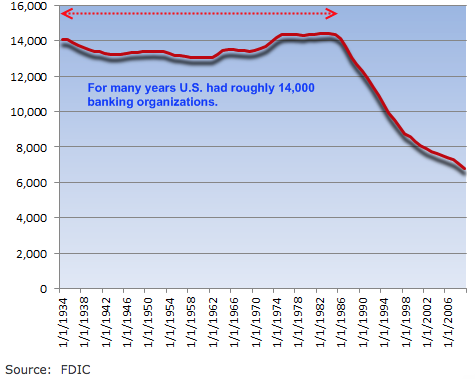

When the Beatles sang “Money (That’s What I Want),” there were roughly 13,000 U.S. financial institutions.

When the Beatles sang “Money (That’s What I Want),” there were roughly 13,000 U.S. financial institutions.

When ABBA sang “Money, Money, Money,” there were roughly 14,000 U.S. financial institutions.

About the time Dire Straits was singing “Money for Nothin’,” the industry took a dive, banks failed and consolidation increased.

Today, there are about 6,000 each of U.S. banks and credit unions. That’s about 12,000 financial institutions to choose from while you listen to your favorite song about money.

We have one client who is doing a merger conversion this weekend and another who is starting to court a potential merger suiter who’s in financial trouble. Consolidation is our reality in bank and credit union land.

We even have larger credit unions gobbling up community banks now!

What’s funny is the difference in the two industries. With banks, the largest banks keep getting larger while they gobble up competition. With credit unions, 44% have $20 million or less in assets (63% have $50 million or less). In credit union world, and in the case of both of our clients’ situations, the larger or financially healthier credit union is taking in a struggling institution.

What’s funny is the difference in the two industries. With banks, the largest banks keep getting larger while they gobble up competition. With credit unions, 44% have $20 million or less in assets (63% have $50 million or less). In credit union world, and in the case of both of our clients’ situations, the larger or financially healthier credit union is taking in a struggling institution.

If you are merging with another institution, here are a few things to consider, from a marketing perspective:

Brand Equity

No one wants to operate with two brands, but it’s worth considering the brand equity of the merged institution. If it’s a converging of two like-size institutions, can you put pride aside and move to the brand that has the best equity? Should you? I wish there was an answer.

Just remember, the older the brand, the larger the customer or member base, the better known they are, the more challenges you’ll have.

Retention

People are most likely to change financial institutions when there are ripples. And a merger is a major ripple! Communicate early and often:

People are most likely to change financial institutions when there are ripples. And a merger is a major ripple! Communicate early and often:

- They want to know why this is happening. Tell them!

- Are you going to make it easy on them so they don’t have to change cards and checks? Tell them!

- Will they need to take action because of this? Tell them!

- Are you keeping the same branch staff? Tell them!

- Do you offer products, services or access that they don’t have today? Tell them!

- Where is “the suck?” What do you expect they will NOT like about the merger? Tell them about it before they experience it.

Acquisition

Let’s face it, if everything was rainbows and butterflies with the merged institution, they wouldn’t be merging. Odds are, the incoming customers are not using the institution to its full potential.

- Analyze the demographics of the incoming customers.

- Analyze product and service usage.

- If they are not doing most of their banking with you, who are they going to? Assume the market share leaders if you can’t determine it.

- Differentiate your new relationship against BOTH the old institution and the competition.

- Ask for the sale.

- Make opening the accounts easy.

- Remember, even if they’ve been with the old institution for 20 years, this is YOUR first impression on them. Keep them happy. Thank them after they open new accounts. Give them every reason to come back for more.

Since MarketMatch works exclusively with credit unions and community banks, every merger that we’ve helped clients through has been a win-win for the institutions and their customers or members. A merger is like a marriage, and like any good marriage, communication is key – between the couple and among their extended families.

In addition to being a strategic consultant for community banks and credit unions, MarketMatch also has nationally and internationally requested speakers. Contact us to bring our marketing ideas to your institution or next conference.

See our story here. (click)

Or email me directly (click)

937-371-2461

Follow us on Twitter @MarketMatch