At MarketMatch, we have seen the importance of approaching EVERY job with as much data as possible.

There is no more important time to collect and present data than when you are preparing for your annual planning session.

You Need to Analyze Yourself:

You Need to Analyze Yourself:

- Where is your income coming from?

- What is your loan portfolio mix?

- From what loan products are seeing the most growth?

You Also Need to Look Beyond Your Call Report

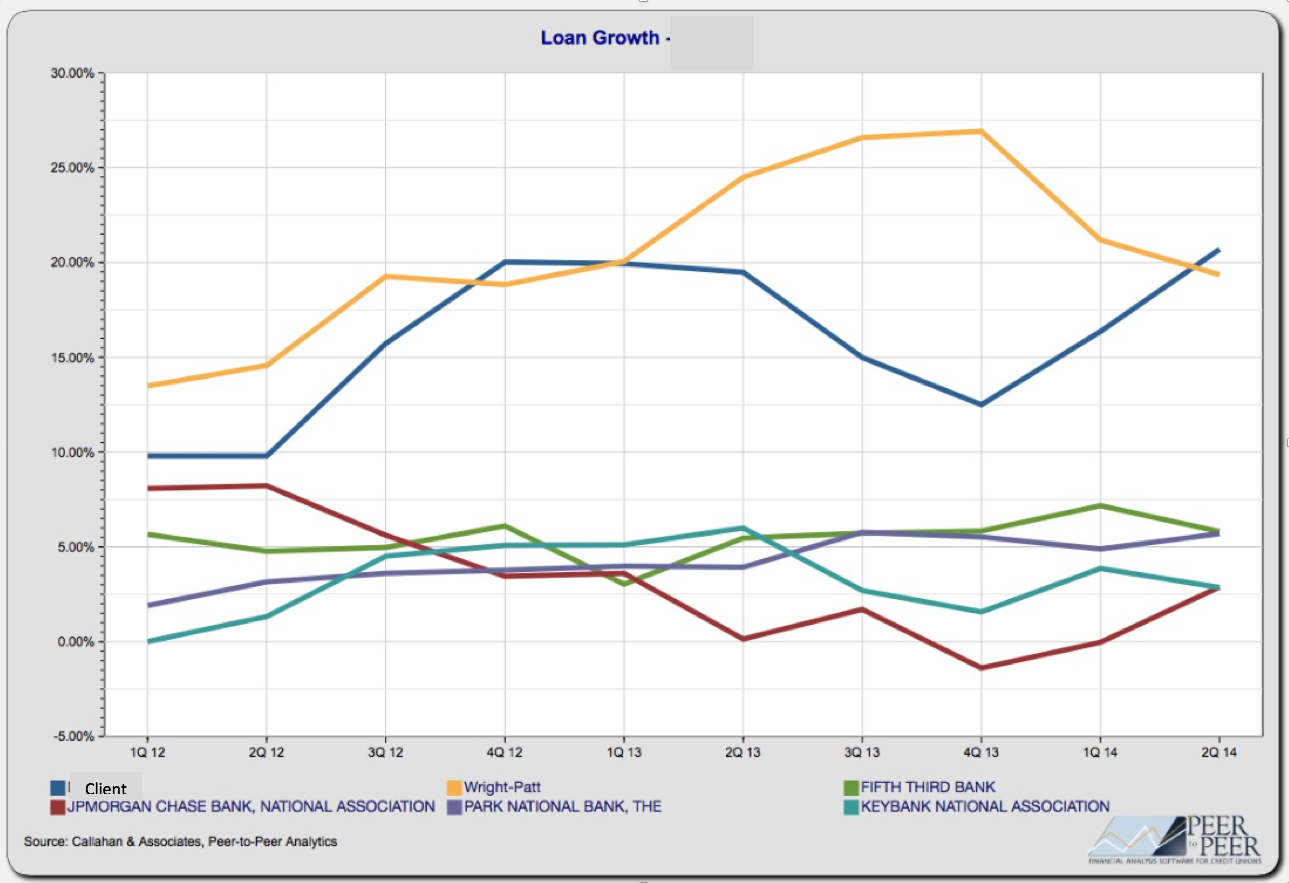

Imagine the difference in the level of discourse if you, your management team and your Board all understand how you are trending compared to key local competition in:

- Asset growth

- Loans /Assets

- Loans/Deposits

- Loan Balance growth (overall and specific to each product)

- Average loan balance (overall and specific to each product)

- Loan penetration (by product)

- Yield on loans

- Delinquency

- Net charge-offs/Average loans

- Net interest margin

- Checking growth (accounts)

- Average checking balance

- Deposit market share (compared to the number of branches in the market)

- Customer growth

- The number of customers filing for bankruptcy

- Customers/employee

- Net income/Employee

- Revenue per Employee

- Core earnings ratio

- Efficiency ratio

- ROA

Certainly you can share all of this information about YOUR institution. And looking at yourself, alone, allows you to know if you’re trending up or down.

But, when you compare yourself with your key competitors, you have a completely different context. Now you know if your specific trends are consistent in the market.

- Yes, you may experience growth in a key area. And that growth may be better than last year … but are your competitors doing even better?

- Yes, you may be experiencing a decline in another area … but is something happening to make everyone experience the same decline and are you actually faring better than the competition?

What if you could look at this same information compared to other banks and credit unions of your size nationwide?

What if you could look at this same information compared to other banks and credit unions of your size nationwide?

- Are banks and credit unions experiencing different trends? Would it matter to your planning?

- Are you ahead or behind other institutions in your asset range? Why?

Our Recommendation

- Gather this information at least a week before your planning session

- Share all of the data with your management team PRIOR to the planning session and discuss.

- What are the most important stats that stand out?

- Why do you feel you are ahead or behind?

- Begin your planning session with presenting this data and your assumptions to everyone in attendance.

When you begin your planning session by looking at empirical data about yourself, your market and your competition, you provide the tools for more intelligent conversation. You assure that everyone in the room has facts which tends to limit the amount of side-tracked, one-off opinions, that too often eat up time in planning.

If this was helpful, check out “The Loudest Voice in the Room: Strategic Planning”

In addition to being a bank and credit union strategic consultant (and strategic planning facilitator), MarketMatch also has nationally and internationally requested speakers. Contact us to bring our marketing ideas to your institution or next conference.

See our story here. (click)

Or email me directly (click)

937-371-2461

Follow us on Twitter @MarketMatch